While the healthcare world celebrates Stars-linked platforms and generative AI for behavioral triage, someone still has to answer a simpler question:

Can peer support actually scale without compromising trust or blowing up margin?

Everyone’s selling human connection at scale. But scaling peer care requires more than good UX and case studies. It requires audit readiness, economic durability, and proof that members will keep showing up when the conversation is machine-scanned.

Today, we’re looking at Marigold Health, a company that’s spent nearly a decade trying to thread the needle between Medicaid-aligned peer support and NLP-powered behavioral risk escalation.

This is #F15

You’re reading a Fundable 15 Black Brief, my weekly drop on the most fundable, ROI-clear social care orgs flying under the radar.

Built for MA execs, funders, strategists, and M&A leads who know what Stars volatility feels like on a Monday.

This is Part 3 of 3 in our current series:

The New Infrastructure of Care

Part 1: Solace Health ✓ (Medicare onboarding + Stars retention)

Part 2: Wayspring ✓ (Delegated SUD infrastructure)

Part 3: Marigold Health (Peer ops + NLP escalation logic)

What They Actually Do

Marigold Health offers chat-based peer support, augmented by a natural language processing (NLP) engine that flags behavioral risks in real time. The system routes alerts to clinical supervisors for review.

The idea: scale peer engagement while reducing the supervisory overhead needed to keep it safe, effective, and auditable.

👉🏽 Peer-led, HIPAA-compliant group chat

👉🏽 NLP risk scoring layered over text data

👉🏽 Contracts in MA, MD, NM (Medicaid + DSNP)

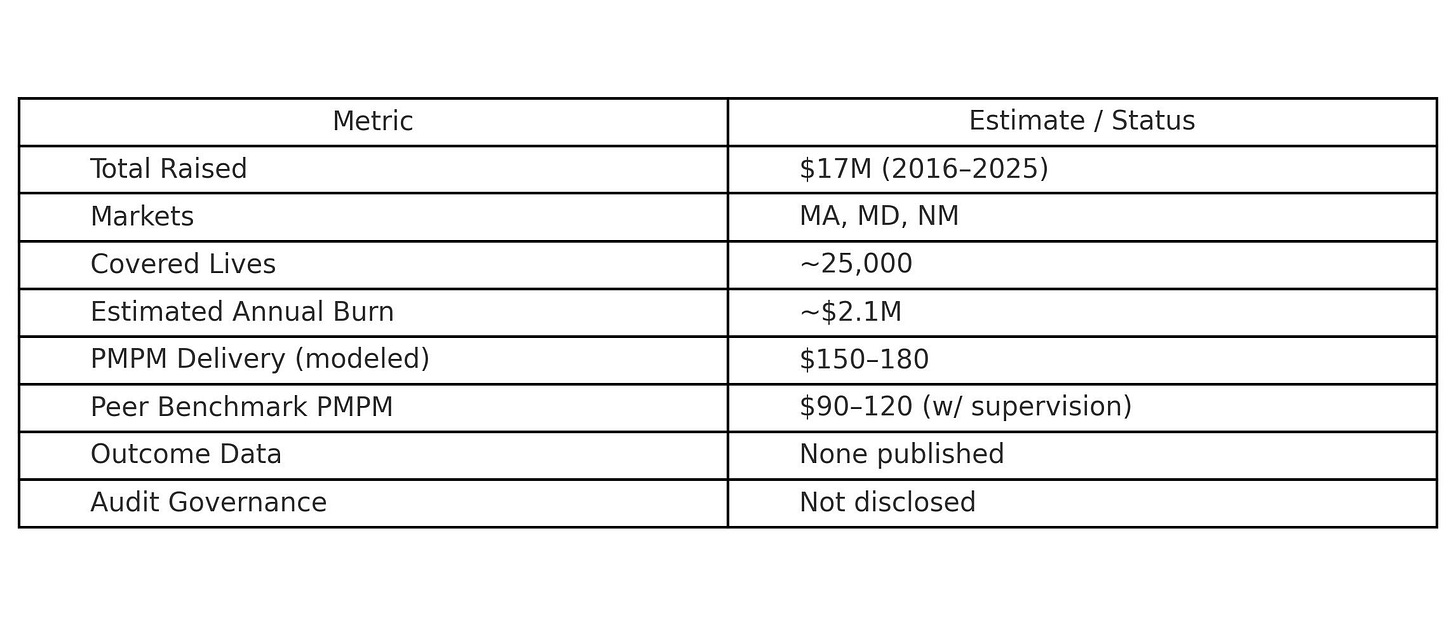

👉🏽 ~$17M raised since 2016

👉🏽 ~25,000 covered lives

The Intel

Why This Matters Now

CMS 2026 will demand documented audit trails for AI-enhanced decision systems. Any platform triggering care escalation (like Marigold’s NLP model) must be able to show:

Escalation logic

Override tracking

Stars-linked attribution

Marigold has not publicly disclosed audit governance, override logic, or Stars attribution methodology. This absence limits what external evaluators can underwrite in terms of CMS 2026 readiness or Stars-aligned valuation.

The Embedded Tension:

Peer support works because it feels safe.

Marigold’s product thesis is built on a tightrope:

On one side: Peer support works when people feel emotionally safe. That safety hinges on trust, confidentiality, and non-clinical tone.

On the other side: CMS 2026 audit protocols demand transparency, documentation, override tracking, and the ability to defend decisions that influence care.

Plans, vendors, and state programs will need to demonstrate:What the model does

How it escalates

Who can override

Whether outcomes improve

This creates a fundamental tension:

The very moment peer support becomes auditable, it may become less trusted.

But if it isn’t auditable, it won’t be fundable or contractable under Stars-linked procurement.

To date, Marigold (like many in this space) has not publicly resolved this tension, as no override audits, escalation logic, or outcome attribution have been disclosed. If those elements remain undocumented beyond the sales deck, the market can’t underwrite them financially or operationally in this new reality.

The Data

Marigold’s PMPM is modeled at $150–180 (Full modeling breakdown below)

Resulting PMPM range: $150–180, assuming conservative member-to-peer ratios, intensive QA on NLP outputs, and moderate underutilization. In leaner staffing conditions, this could drop to ~$120 PMPM but current signals suggest a higher-cost baseline.

That means it is:

30–60% higher than peer support industry benchmarks

With no public Stars or FUH/FUM attribution

And no documented audit readiness to de-risk the NLP layer

Takeaway:

Marigold’s modeled PMPM is 20–50% above comparable programs. Unless Stars impact, cost offset, or trust-based retention can be demonstrated, the model exceeds payer tolerance in Medicaid and MA markets.

The Investment Thesis

The Bull Case

CMS accepts NLP logic + override process in audit protocols

NLP reduces supervisory costs enough to normalize PMPM

Stars impact validated, and buyers embed Marigold in care ops stack

The Bear Case

Stars impact remains anecdotal

NLP logic lacks transparency → flagged in CMS audits

Member trust erodes as escalations increase

2026 procurement cycle passes without compliance milestones met

The Fundable Verdict

Status: Not fundable. Possibly acquirable.

The value here is:

Peer ops workflows

MCO contracts

Field-tested product-market fit in tough segments

But not the tech.

Strategic Value

Buyers with audit-ready Stars infrastructure could extract:

Contracts

Ops team

Medicaid trust capital

…and sunset the NLP stack entirely.

Estimated acquisition range: $5M–$12M

Based on contract durability, margin potential, and ops quality, not IP.

Strategic Buyers

The buyers best suited for Marigold are the ones looking for audit-ready behavioral infrastructure that supports Stars performance, while already having clinical capacity and compliance infrastructure. What they’re missing is a scalable, trusted peer ops layer. Buyers like Devoted, CareBridge, Unite Us, Cityblock, SCAN, and PE platforms building Stars-aligned wraparound services make sense because they can absorb the contracts, fold in the workforce, and drop the tech stack.

Who doesn’t make sense: Tech-first startups, Series A growth plays, or innovation labs looking for differentiated IP.

The Quiet Move

Don’t buy it. Test it.

Pilot the NLP in a no-risk setting. Measure:

Alert frequency

Override rate

FUH/FUM movement

Member trust after escalation

If it works, negotiate for the team + contracts.

If not, pass cleanly.

What to Watch

Expansion Signals

CMS eval or Stars-linked outcome release

Override audit logic disclosed

MA plan renewals or new DSNP launches

Red Flags

Delay in audit logic publication

Contract attrition in current states

Leadership gaps in compliance, product, or payer engagement

The Bottom Line

Marigold is a real operator in a real space. But peer support + NLP still hasn’t proven it can move Stars metrics at scale without compliance friction or trust decay.

Verdict: Watchlist only.

Acquire the ops if you must. Retire the tech if you do.

Tips or signals: christina@christinar.media

Full PMPM breakdown of Marigold Health including staffing ratios, NLP QA costs, and margin risk zones below:

Estimated PMPM Cost Modeling Breakdown: Marigold Health

Estimated delivery cost of NLP-supported peer support services based on public info and industry benchmarks

Keep reading with a 7-day free trial

Subscribe to The Fundable 15 to keep reading this post and get 7 days of free access to the full post archives.