#F15 Black Brief Drop: Solace Health (The Platform Payers Should Have Built)

The Fundable 15 Memo: Q3 2025 (Week 3)

There are companies that chase the spotlight.

And then there are companies like this—quiet, built for function, and more influential than they let on.

Solace isn’t trying to disrupt.

It’s trying to blend in—into workflows, into Stars strategies, into plan performance teams already stretched thin.

And that might be the most strategic move of all.

What This Brief Covers:

The CPT + HCPCS codes Solace is likely billing under—and the documentation, delegation, and reimbursement caveats that come with them

Expansion signals across Medicare Advantage, municipal contracts, and Stars-sensitive states (CA, FL, AZ)

Competitive positioning vs. Carallel, Signify Health, and payer-owned navigation teams like SCAN and UHG

Exit logic grounded in real M&A comps—from Signify to naviHealth—not inflated tech multiples

Strategic questions every funder, acquirer, or operator should ask before backing navigation infrastructure

Note: This brief synthesizes public data, operating patterns, and expert inference. It is not a valuation document or investment recommendation.

The Short Version

Solace Health is a CMS-aligned care navigation company positioning itself as Stars infrastructure for Medicare Advantage and D-SNP plans.

They’re credentialed with MA payers, referenced in public contracts, and rapidly building a marketplace of certified advocates across multiple high-volatility Stars states.

Their claim:

We can handle the friction payers don’t have time to solve.

Payer Alignment: What We Can Confirm

⚠️ Note: CPT codes like 99401 and T1017 are not universally reimbursed across MA carriers.

Documentation, delegation, and integration with care plans matter.

Reimbursement & Billing Architecture

Solace doesn’t explicitly publish rates, but based on market proxies:

Estimated PMPM Range (proxy):

$38–$125, depending on:

Member type (FIDE SNP, D-SNP, LIS)

Complexity of engagement

Delegation structure (direct vs through provider group)

⚠️ Theoretical ranges. Real-world PMPMs are often suppressed unless linked to measurable MLR reduction or Stars gain.

Market Landscape

Solace does not operate in a vacuum.

Its model overlaps or competes with:

Solace differentiates with:

A certified advocate marketplace

Public sector traction (municipal contracts)

Remote-first intake with centralized MD triage

📌 As of now, Solace has no publicly shared comparative ROI data, which competitors like Carallel have published through partners.

Funding & Scale Trajectory

The team includes clinicians, engineers, and payer-facing strategists.

Hiring is concentrated in CA, FL, and AZ—all Stars-critical states.

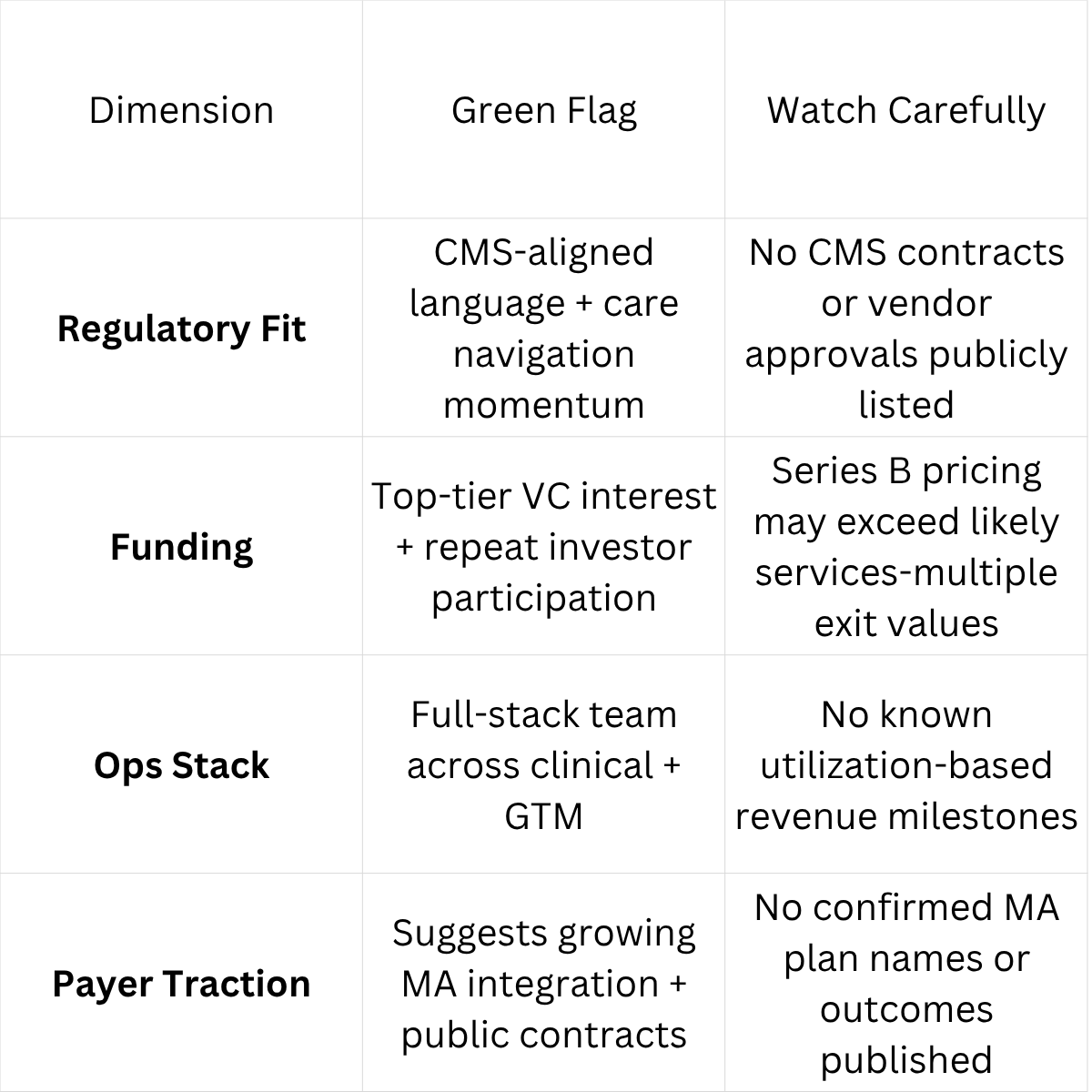

Risk Matrix

Strategic Framing

Solace is making a subtle bet:

That MA plans want to outsource the messy middle—member literacy, care plan initiation, retention risk—and will pay someone else to handle it.

And while many health plans have their own internal teams, the pressure of Stars volatility, CAHPS sensitivity, and compliance fatigue may create a window for platforms like Solace to earn a seat at the table.

But for funders and operators, the key question is not:

Does this work?

It’s: Can this win against the incumbent workflows that already exist?

Exit Tracks: What Recent Acquisitions Tell Us About Navigation, SDoH, and Infrastructure Plays

These are not tech deals.

They’re revenue-backed services platforms sold to payers, risk-bearing providers, or PE consolidators—often in under-the-radar strategic tuck-ins.

Solace likely won’t exit at tech multiples unless they prove two things:

Contracted payer revenue that renews

ROI that shortens Stars remediation cycles or CAHPS volatility

If Solace succeeds, it won’t be because they shouted louder.

It’ll be because someone in a Stars task force needed a playbook—and this model showed up ready.

Every payer is making Stars decisions right now.

Some are buying infrastructure.

Some are still trying to build it.

Solace sits in that gap.

And now, you have a blueprint to interpret who’s next.

My breakdown on Wayspring drops next week. Behavioral, backed by CVS, and operating in silence. Subscribe to get it first.

—Christina R.

The Fundable 15